Get This Report on Offshore Business Formation

Table of ContentsWhat Does Offshore Business Formation Mean?Things about Offshore Business FormationOffshore Business Formation Things To Know Before You Buy6 Simple Techniques For Offshore Business FormationThe 2-Minute Rule for Offshore Business Formation

It is additionally worth keeping in mind that Hong Kong is not considered a 'tax place', and also will certainly not be affected by the (as it is currently above the minimum). Hong Kong's tax system does not have any type of indirect taxes such as the Valued-Added Tax (BARREL) or Item and also Provider Tax (GST), such as those that apply in the UK, the European Union, Australia, or New Zealand.

Some Known Details About Offshore Business Formation

As Soon As the Hong Kong overseas company is incorporated you will certainly obtain from the Companies Windows registry. As for, you have to sign up within one month from the consolidation of your brand-new Hong Kong offshore business - offshore business formation. Currently the Inland Earnings Division has actually set the "One-stop business as well as organization registration service", when an applicant provides the unification creates with the Firms Computer system registry will certainly be taken into consideration to have made the application for the Service Enrollment certification at the very same time, conserving time for candidates.

The city has a wide range of service providers between conventional banking, virtual banks, and payment solutions that can provide a local company checking account or organization make up firms included in see this page your area. However, each organization has a details niche of the market they serve as well as internal requirements for account application that can differ from one establishment to an additional.

If you desire to get more information concerning the procedure of how to, You can see our web page ready to find out more about the process of how to open up a company account and recognize more about the various options offered for offshore firms - offshore business formation. It is extremely common to perplex the term offshore business in Hong Kong.

Offshore Business Formation - The Facts

It is generally considered that the mere fact of including a company from another location will give the firm in Hong Kong the automatic right to be categorized as an overseas firm by the Inland Profits Department and also have access to the Profit Tax obligation price of 0%. offshore business formation. When presenting a situation to the Inland Revenue Department business have to prove their source of see this income comes from territories beyond Hong Kong.

For example, a firm doing international service sourcing in China and also selling overseas. Is extremely usual that Chinese suppliers invoice to the Hong Kong business through one more company in Hong Kong, in this situation, the resource of the earnings may be taken into consideration from Hong Kong and the business most likely will not be approved the overseas status.

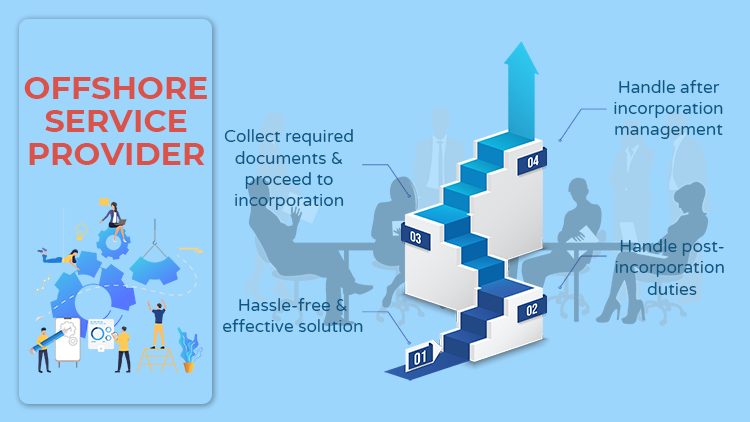

In some scenarios there might be advantages in scheduling overseas firm formation and share issues for your company. Morgan Reach can assist with offshore formation services and share issues in several locations and can likewise help with offshore banking and renewals. There are 2 primary reasons to develop an Offshore Business, Tax benefits, and legal protection.

Excitement About Offshore Business Formation

Being among the quickest creating on the globe and also showed to be probably the his response most effective spot to start a service, an overseas company formation in UAE accommodates all essential and also thrust politeness for an organization. offshore business formation. An overseas business development in Dubai can be asserted by individuals or business bodies and also is a business component that does not finish any kind of substantial company movement in its country of creation.

Such a firm is surrounded under the no-tax territory law with the sole reason for boosting one's treasures the board and minimizing any type of tax installment lawfully. There are a few explanations behind overseas companies signing up with UAE, with the important one being finished secrecy over the economic issues as well as increment in treasures without disturbance.

Little Known Questions About Offshore Business Formation.

This exchange tax obligation can be properly kept a tactical distance from marketing the company itself. Not many building designers around the globe consider greater than a solitary landowner. In the event of an offshore firm in UAE, however, the number of capitalists can be 1-50, and the firm possesses the residential or commercial property.